The Global Retail Surge: Why 11.11 & Black Friday Matter — and What Australian Brands Must Do to Win Chinese Shoppers

November marks the most commercially charged period on the retail calendar — a convergence of major global shopping festivals:

11.11 (Singles’ Day) — China’s largest shopping event

Black Friday & Cyber Monday — now a global retail phenomenon

Followed by 12.12, Christmas, Boxing Day, and a ramp up to Chinese New Year 2026, the next high peak travel season.

For brands, this season isn’t simply about promotions. It represents a shifting landscape of global consumer behaviour, cross-border shopping, and omni-channel retail.

And for Australian brands specifically, it is one of the most strategic periods to capture Chinese consumers, both online and in-store.

🌐 11.11: Still the Most Influential Shopping Event in the World

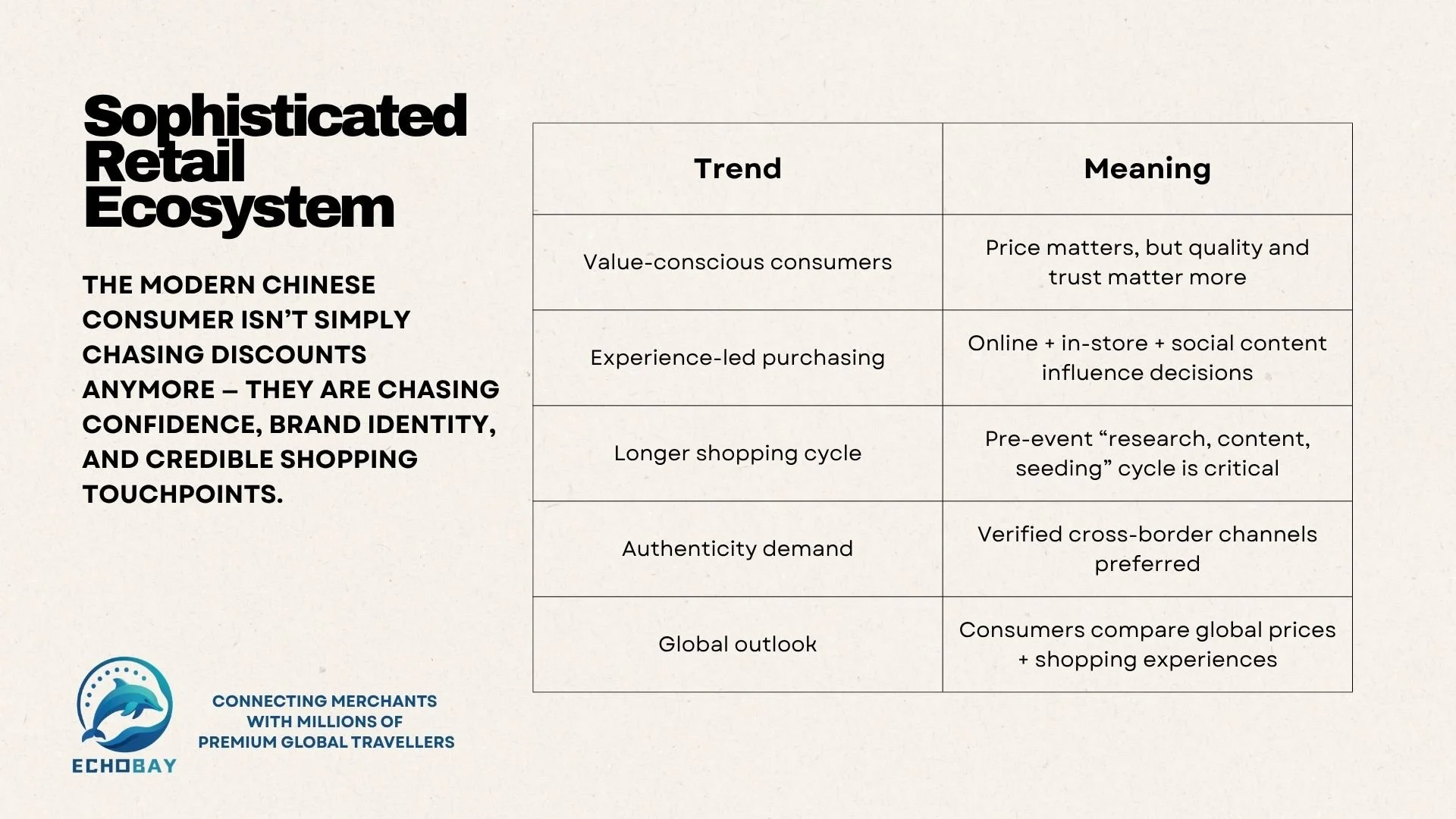

A decade ago, 11.11 was synonymous with record-breaking e-commerce flash sales. Today, it has evolved into a sophisticated ecosystem driven by:

The modern Chinese consumer isn’t simply chasing discounts anymore — they are chasing confidence, brand identity, and credible shopping touchpoints.

🇦🇺 Black Friday in Australia Is a Chinese Shopper Magnet

Black Friday has matured into one of Australia's most important retail events — especially for:

International students

Local Chinese communities

Returning tourists and visiting family

Cross-border shoppers who compare AU vs CN pricing

Luxury and premium shoppers seeking authenticity and tax-free advantages

Unlike many global markets, Australia holds unique appeal:

🌿 Clean origin + local manufacturing trust

👜 Access to global luxury brands

💰 GST refund + duty-free benefits

🧴 Strong beauty, health, and lifestyle categories

🇦🇺 “Authentic Australian brand” halo effect

For Chinese consumers, shopping in Australia is both an experience and a proof point of quality.

📱 The Online-to-Offline Reality: Content Drives Store Visits

A key consumer shift:

Shoppers are increasingly inspired online, but buying offline.

Content, social proof, and platforms like Ctrip influence decisions before a consumer ever steps into a store.

That means:

✔ Search interest spikes before 11.11 & Black Friday

✔ Consumers plan shopping routes

✔ They compare prices across platforms

✔ They look for promotions and rewards

✔ They expect international payment options

Simply put — if your brand isn’t visible when the research starts, the sale won’t happen when the shopper arrives.

🧭 Key Consumer Insights for Brands

Modern Chinese consumers prioritise:

Winning brands take a “trust-first, culture-aware, experience-led” approach — not just a discount-led one.

🎯 Why This Matters for Australian Retail

Australia has the right fundamentals to thrive:

✅ Strong brand trust in China

✅ High-quality product categories (beauty, lifestyle, wellness, food, wool/sheepskin)

✅ Natural retail/tourism synergy

✅ Returning Chinese tourism and student flows

But historically, many Australian brands have lacked:

Consistent visibility in China-facing ecosystems

Strong affiliate and KOL-driven content

Chinese-friendly in-store experience

Integrated online–offline strategy

This shopping season is the moment to change that.

🚀 How Australian Brands Can Win This Season

1) Be present where Chinese shoppers discover brands

Platforms like Ctrip build trust and visibility long before a tourist arrives.

2) Build a Chinese-friendly shopping journey

Alipay / WeChat Pay / UnionPay acceptance

QR codes for information or promotions

Bilingual signs or welcome messages

3) Offer value creatively

Gift with purchase > deep discounting

Exclusive in-store perks

tourist-friendly bundles

4) Use affiliate & community channels to promote incentives

Social + referral + content ecosystems convert better than ads. (Ctrip Global Shopping Program)

5) Track, learn, and iterate

Understanding Chinese shopper behaviour now = long-term advantage.

💡 The Bigger Picture

11.11 and Black Friday are not just sales events.

They are cultural benchmarks for consumer behaviour and cross-border retail evolution.

Brands that succeed today will be those that:

Understand cultural context

Build discoverability

Prioritise trust and convenience

Invest in a long-term China-engaged strategy

This is not about chasing a sales spike.

It’s about positioning your brand to win the global Chinese consumer of the future.

Where EchoBay Global Comes In

EchoBay Global helps Australian brands connect with Chinese consumers through:

Ctrip Global Shopping merchant onboarding

Chinese-facing affiliate and influencer marketing

In-store enablement for Chinese payments and experience

Content and strategy that respects cultural behaviour and brand integrity

We exist to help local brands be discoverable, credible, and chosen by one of the world’s most economically influential consumer groups.

📩 ARE YOU READY?

We are onboarding Australian merchants now.

If you’re a retailer or brand looking to:

✅ Reach Chinese travellers & consumers

✅ Be featured on Ctrip Global Shopping

✅ Enable Chinese payment & loyalty solutions

✅ Build cultural and shopper-led marketing strategy

👉 Apply to join EchoBay Global’s merchant network

📧 info@echobay.com.au

Follow us for more insights into cross-border retail, Chinese consumer behaviour, and global tourism commerce.

“The global shopping season has begun — where your brand appears now determines who chooses you later.”